Understand your vulnerabilities with confidence

Protect your business with Bluewire’s first-of-its-kind severity risk reporting.

Better decisions start with Bluewire

Insurance | Motor Carriers | Freight Brokers | Suppliers

Bluewire GAP Score

The Bluewire AI platform proactively analyzes complex data sets from multiple industry sources and scores the severity risk of over 750,000 regulated motor carriers. The Bluewire GAP Score summarizes a company's overall severity risk while the 9 severity GAP categories represent the critical vulnerabilities associated with the severity gaps often exploited by plaintiff attorneys to drastically increase the severity of a claim.

Bluewire GAP Score lets you:

See how all registered DOTs stack up to one another

Reduce 750,000 records into a manageable size

Easily set advanced filters including: classification, status, safety rating, state and more

Enter single or multiple DOT numbers to customize your list of carriers to track

Gain insight into what affects individual scores and how to improve them

Export filtered data to csv file for offline use

Quickly see how to lower the combined risk of motor carriers and their insurance partners

Prospect new business with reliable analysis and insight

Severity GAP categories

Bluewire has developed the 9 severity GAP categories that are most often exploited by plaintiff attorneys to drastically increase the severity of a claim. For more than a decade, plaintiff attorneys who have been successful in exploiting only one of these vulnerabilities have yielded a victory and won excessive settlements against the trucking company and their insurance partner.

Severity GAP categories show you what affects your GAP score and where to focus your improvement efforts:

Crash Gap: Your crash rate compared to your peers

Violations Gap: Violation groups that impact severity

CSA BASICs Gap: CSA defects that make you vulnerable to high severity claims

Driver OOS Gap: Driver out of service rates compared to your peers

Critical Acute Violations Gap: The presence of critical and acute violations discovered during compliance reviews

New Entrant Gap: Heightened scrutiny during the 18 month entrant period

MCS-150 Gap: Your MCS-150 score based on timeliness and accuracy of your MCS-150 filing

Judicial Hellhole Gap: Operating in a plaintiff-friendly jurisdiction can expose you to increased vulnerability to high-value claims and excessive settlements

Safety Rating Gap: Unsatisfactory and conditionally rated carriers are exposed to greater severity risk

Severity GAP Drill Down

Understanding the underlying data is key to uncovering your gaps and vulnerabilities and knowing where to focus to address them.

With Bluewire, knowledge is power:

See the exact crash or violation detail for every incident

See how Bluewire assigns severity points for every incident

Find areas in need of improvement

Notice trends early and proactively get ahead of them

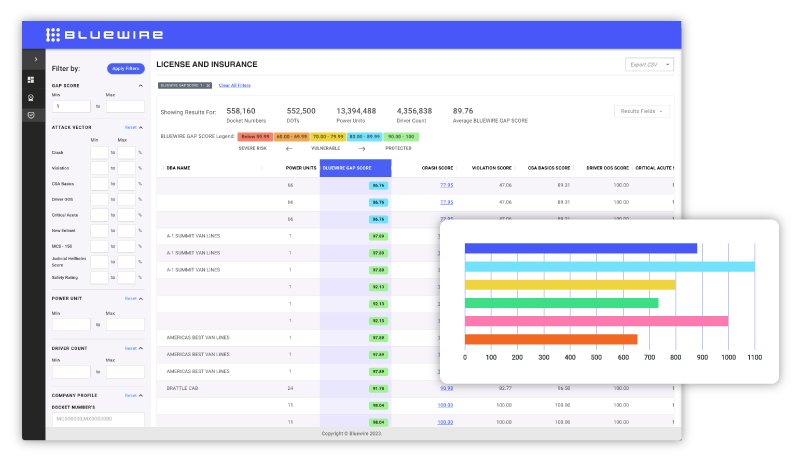

License and Insurance

License and Insurance (L&I) shows more than 1.6M dockets detailing the insurance relationships between motor carriers and their insurance company.

Bluewire shows you:

Types of insurance, cancellation dates, insurance companies and blanket company information

70 columns of data that you can quickly sort, filter, reduce and review

The list of motor carriers a specific underwriting company insures along with their average GAP score

Expected renewal dates for carriers filtered with a date range for policy effective date

Motor carriers with coverage above a specific monetary threshold

Specific types of coverage like cargo or bond

Severity Report

Bluewire proactively scores the severity risk of over 750,000 regulated motor carriers. Through our online subscription service, the trucking industry is able to analyze the vulnerabilities that create exposure to financial liability, excessive verdicts and settlements and catastrophic loss. Incorporating Bluewire into a stewardship plan allows trucking companies and their insurance partners to work together to minimize these threats...before a crash.

Bluewire shows you:

Graphical representation of the Bluewire GAP scores

Map of Judicial Hellholes® and trouble spots

Comparison with like carriers in critical GAP categories

Where to shore up and improve vulnerabilities

Bluewire Analytics

Unlocking a new realm of analysis for risk management, access our state-of-the art library of flexible reports. Designed to be dynamic and adaptable to our varied audience of insurance brokers, insurance carriers, freight brokers, shippers, industry suppliers and defense attorneys. Bluewire Analytics is capable of evolving alongside shifting risk landscapes.

With Bluewire, knowledge is power:

Gain insight and discovery with patterns, trends, and relationships deep within the data

Support informed decision-making by presenting data that enables stakeholders to grasp implications more readily

Enable continuous monitoring and scheduled push-reporting of key metrics and performance indicators over time

Facilitate effective communication of data-driven findings and recommendations to diverse audiences